NOTICE:

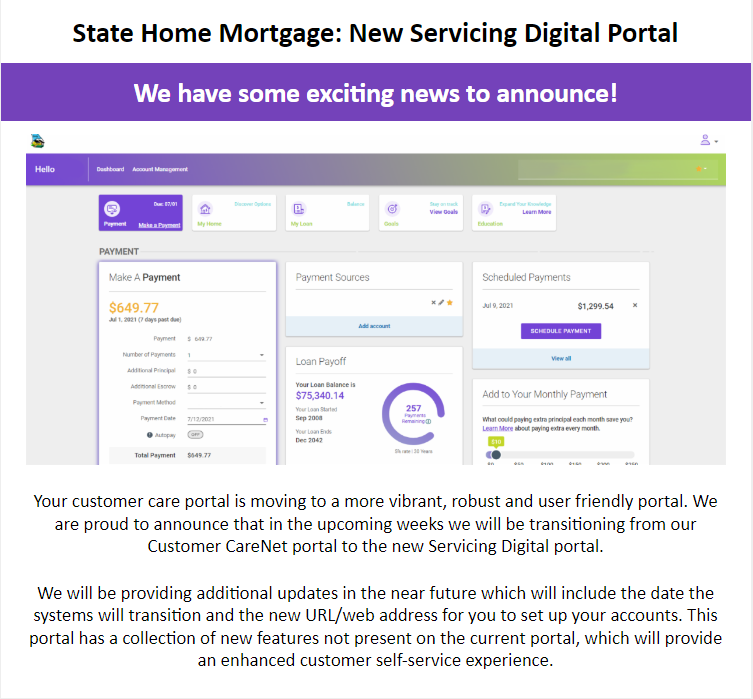

SERVICING DIGITAL ONLINE PORTAL

PLEASE USE THE FOLLOWING URL TO ACCESS YOUR ONLINE PORTAL TO MANAGE YOUR MORTGAGE LOAN SERVICING DIGITAL

PLEASE DO NOT SEND US YOUR TAX BILL UNLESS WE REQUEST IT

FOR INSURANCE RELATED INQUIRIES CONTACT - insurance@dca.ga.gov

FOR ESCROW RELATED INQUIRIES CONTACT - escrow@dca.ga.gov

FOR TAX RELATED INQUIRIES CONTACT - tax@dca.ga.gov

************IMPORTANT ANNOUNCEMENT-UPDATED*********

To Our Valued Customers,

We at State Home Mortgage understand the concern and uncertainty you may be experiencing surrounding the coronavirus (COVID-19) and are committed to being responsive to the needs of our customers and employees.

We are closely monitoring updates from public health officials and government agencies so that we can make ongoing assessments.

To limit the potential impact of COVID-19 on our employees, and our valued customers, we are working with limited critical staff.

The passage of the Coronavirus Aid, Relief, and Economic Security (CARES) Act stipulates that every borrower who attests that they have been directly or indirectly impacted by the COVID-19 pandemic, regardless of delinquency, is entitled to a forbearance plan.

What is a forbearance plan? A forbearance plan provides a temporary suspension or reduction of your mortgage payments for a specific period during a temporary hardship, such as unemployment. At the end of the forbearance, you will have three options to bring your account current.

- Pay the total amount due

- Enter into a verbal Informal Forbearance Agreement with SHM to bring your loan current, or

- Complete a full Loss Mitigation Package to be reviewed for options based on your income at that time.

If you have been impacted by COVID-19 and having difficulty with your mortgage payment:

- Please contact our office at 1-800-781-8346

- Select option #3 to speak to a Loan Servicing Representative

- Select option #1 to speak with a Default Representative to discuss your options

- We anticipate high call volume during this period. If your call is not answered, PLEASE leave a voicemail message. Someone on our staff will return your call within 48 business hours.

If you find yourself in need of forbearance support, take a minute to complete and return our streamlined COVID-19 mortgage assistance form. Click on the link below:

COVID 19 FORBEARANCE APPLICATION

Planilla de Asistencia Hipotecaria por COVID-19:

SOLICITUD DE ANULACIÓN DE COVID 19

Additional Resources:

For Georgia COVID-19 Unemployment resources, please visit:

https://dol.georgia.gov/gdol-covid-19-information

For Additional Information on How to Avoid Foreclosure:

https://www.hud.gov/topics/avoiding_foreclosure

Thank you and stay safe.

_____________________________________________________________________________________________________________________________

__________

Click Here to Access

Your New Loan Serving Portal

________________ _______________________

_______________________

State Home Mortgage is the servicing operation for the Georgia Dream Homeownership Program. You can access your loan information here and make your monthly payment online today!

Please send payments, inquiries and written correspondence to:

State Home Mortgage

60 Executive Park South, NE

Atlanta, GA 30329-2231

Phone: 1-800-781-8346

You can also drop off your payment via check or money order in our drop box located just outside our office by our main parking deck.

Note: Effective June 1, 2017 the fee is $5 for a One-Time Draft transaction if you speak to a live representative.

TAX BILLS ARE AUTOMATICALLY PAID BY STATE HOME MORTGAGE AND COPIES DO NOT NEED TO BE SENT IN UNLESS IT IS THE RESULT OF A RECENT TAX EXEMPTION. EXEMPTIONS MAY BE FAXED TO 770-405-7982.

Note: Please have your payment in the State Home Mortgage Office by 3 pm on the month-end cut-off date to ensure adequate posting time.

State Home Mortgage request and receive property tax bills electronically and payment is issued from your escrow account. You, the homeowner, will receive a copy of the tax bill for your records as this is a requirement for city and county tax municipalities. If you are in receipt of a tax bill for a prior year or a bill for solid waste please contact us to determine if your account is escrowed for that payment. You may reach us at 800-781-8346, for your convenience you can also email a copy of the bill along with your questions to tax@dca.ga.gov

As a reminder, State Home Mortgage does not communicate with customers via text message. Official communications from State Home Mortgage will be sent via mail, email or discussed via phone.

To contact State Home Mortgage representatives, send mail to or call:

State Home Mortgage

60 Executive Park South, NE

Atlanta, GA 30329-2231

Phone: 1-800-781-8346